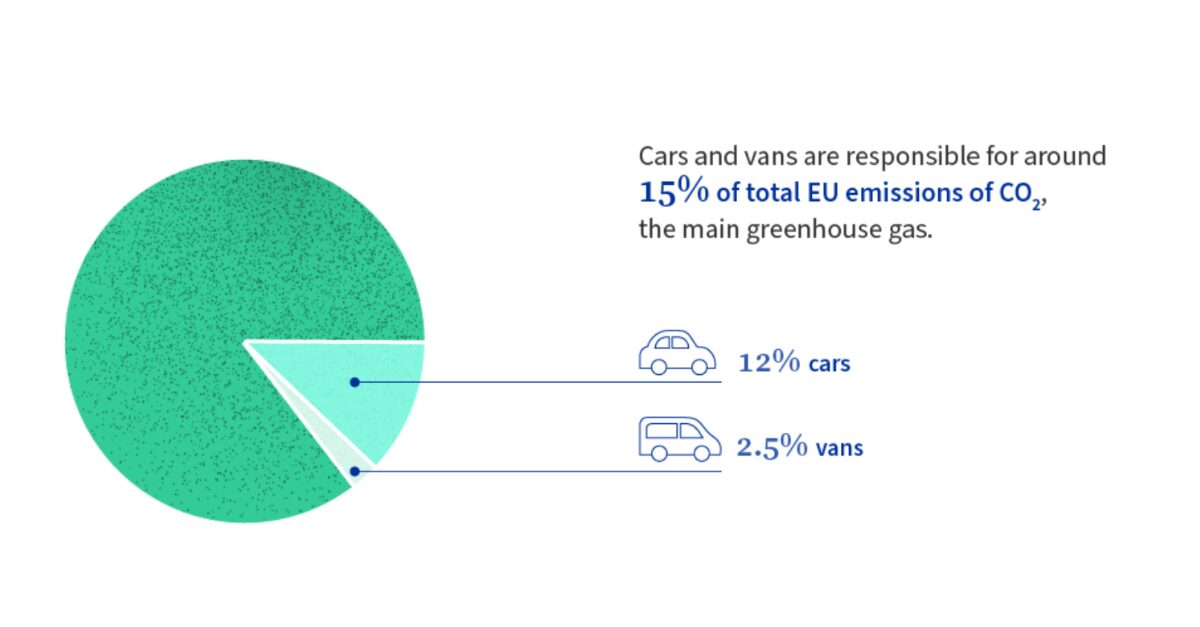

The European Union is aiming for climate neutrality in 2050. On 14 July 2021, the European Commission presented the Fit for 55 legislative package, which sets climate and energy targets for the automotive sector. These targets, from the perspective of the beginning of 2024, may prove to be too ambitious. Under the terms, European Union (EU) member states are to reduce greenhouse gas emissions by 55% from 1990 levels.

What is the Fit for 55 package?

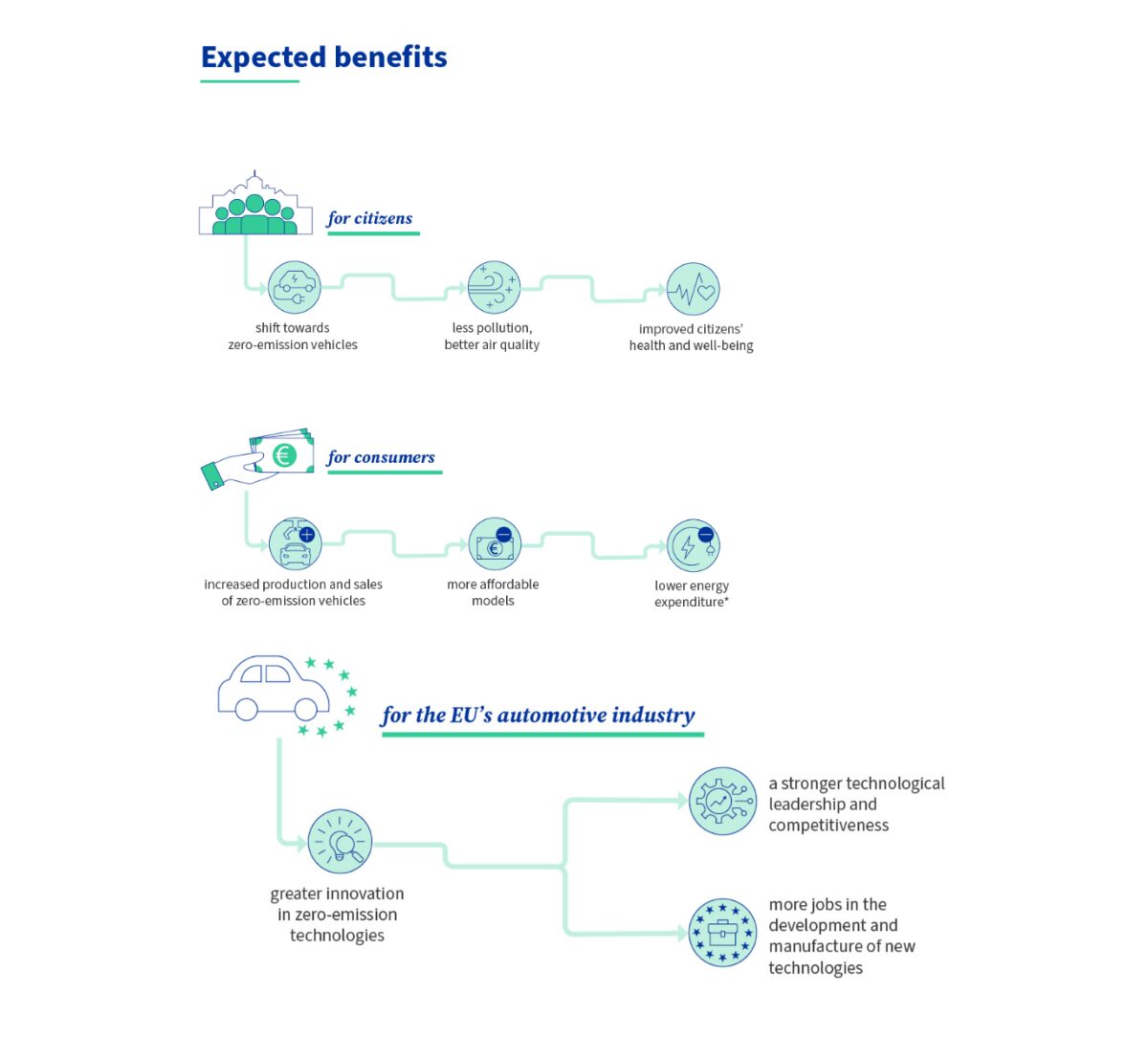

The European Green Deal’s Fit for 55 legislative package is designed to strengthen the European Union’s position as a global climate leader and to modernise existing legislation in line with the 2030 climate targets. It aims to bring about transformational changes in the economy, society and industry to achieve climate neutrality by 2050 and a net emissions reduction of at least 55% compared to 1990 levels by 2030.

Exactly what changes does the Fit for 55 bring to motoring?

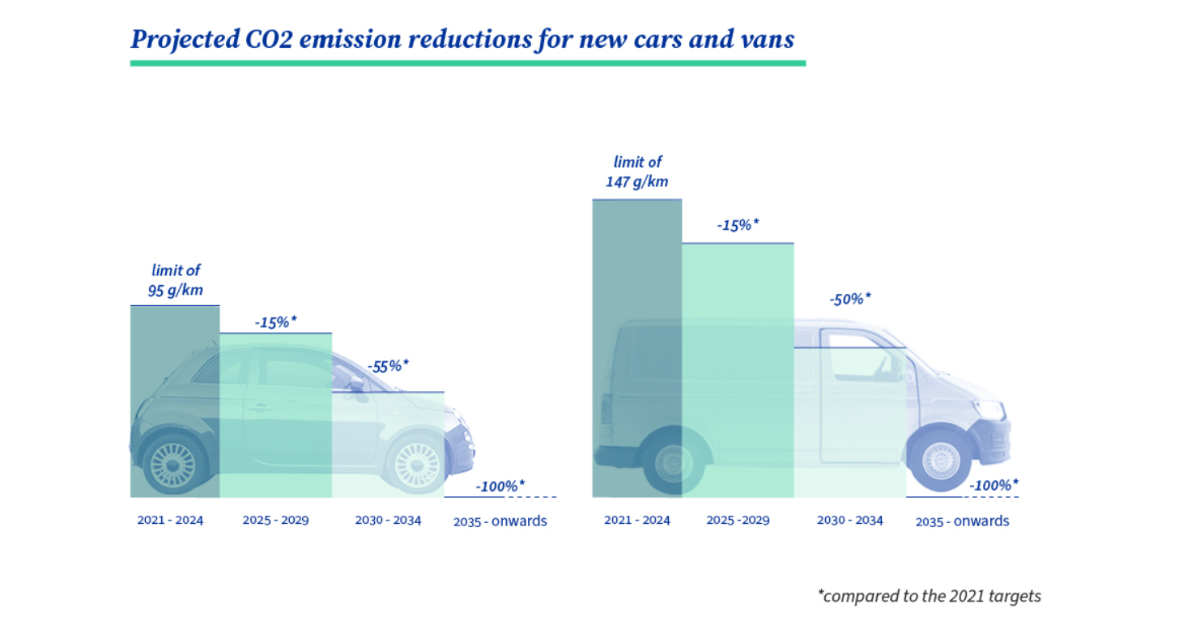

New, more stringent CO2 emission standards for cars and vans will accelerate the transition to zero-emission mobility. They require average emissions from new cars to be reduced by 55% from 2030 and by 100% from 2035 compared to 2021 levels. As a result, all new cars registered from 2035 onwards will have to be zero-emission. This means that in a dozen years or so it will not be possible to register newly manufactured cars with an internal combustion engine in the EU. The European Commission also recommends improving the infrastructure: charging points for electric cars are to be located every 60 kilometres on main roads and hydrogen refuelling points every 150 kilometres.

Analysis of trends in electromobility

Tesla has already met the requirements as a manufacturer of fully electric cars (BEVs). Volvo Cars also envisages a future in cars of this type, and in line with last year’s announcements, the last diesel-powered car (Volvo V60) was produced in the middle of Q1 this year. The brand will sell only all-electric cars by 2030 and aims to become a climate-neutral company by 2040.

BEVs ranked third in terms of popularity among buyers in EU countries and the UK in 2023. In December 2023, new battery electric car registrations fell for the first time since April 2020 (-16.9% year-on-year). This decline can be attributed to the high base in December 2022 and the significant downturn in the largest market for this type of car, Germany (-47.6%). Nevertheless, a total of 1.5 million BEVs were registered in EU countries in 2023 (+37%). The market share of this type of car increased to 14.6% against 12.1% the year before.

The start of 2024 does not appear to be very optimistic. In January, the number of new BEVs registered in EU countries increased by 28.9% to 92,700 units (market share of 10.9%). The four main markets, which together account for 66% of all electric car registrations, saw high double-digit increases:

- Germany (+23.9%),

- France (+36.8%),

- Netherlands (+72.2%),

- Belgium (+75.5%).

In China, the world’s largest automotive market, where demand for electric vehicles is usually high, electric vehicle registrations fell by as much as 38% in January – the first time this has happened since last August.

In February 2024, double-digit registration growth was maintained in Europe in: Netherlands (20.9 per cent), France (+31.8 per cent) and Belgium (+66.9 per cent) but already in Germany demand for electrics declined by 15.4 per cent. Even in China there was a 12 per cent decline.

Changes in the strategies of automotive corporations

There is now a noticeable evolution in the strategies of some automotive corporations towards the pace of electromobility development. Mercedes-Benz announced that it would stop offering combustion-powered models by 2030 at the latest, with more than half of the brand’s sales to be attributed to electric cars by 2025. However, this target will not be realised in time, as demand for electric cars in Europe has fallen. According to the new assumptions, the German company will not abandon the internal combustion engine so quickly. Cars with this drive are expected to be available to customers even in the next decade. The timetable for the introduction of new fully electric vehicles (especially pickup trucks) has also been postponed by GM and Ford.

Toyota Motor believes that all-electric cars will achieve at most a 30% share of the global market. This is in contrast to forecasts, such as the 2024 Oil and Gas Industry Outlook), which state that electrics will account for between 62% and 86% of global car sales by 2030.

Even in developed markets, electromobility will not be able to beat other powertrains. According to Toyota Motor North America, electric vehicles will account for around 30% of the US market in 2030. And this is only half of the target the US Environmental Protection Agency (EPA) is aiming for.

Difficulties of electric start-ups

According to US company Gartner, only the strongest will survive. By 2027, 15% of companies founded in the last decade will be victims of change – they will be absorbed by competitors or, unfortunately, go bankrupt. In Europe, projects by startups Lightyear and Sono Motors have collapsed. Swedish startup Volta Trucks, which specialises in all-electric trucks, has also filed for bankruptcy. The German company Next.e.GO Mobile, which until recently was planning to build factories for small urban electrics in Eastern Europe and the United States, has decided to take the same step.

Summary

The European Union, aiming for climate neutrality by 2050, has introduced the Fit for 55 package, which imposes ambitious targets on the automotive sector. The new regulations require a significant reduction in CO2 emissions, which will accelerate the transition to zero-emission mobility, with a ban on the registration of new combustion cars from 2035. Despite advances in electromobility, not all corporations are ready for such a rapid transition, and some are changing their strategies. The future of motoring in the context of Fit for 55 will require manufacturers not only to adapt technologically, but also to be flexible and responsive to dynamically changing market conditions.

_____________

* Source: AutomotiveSuppliers.pl, European Commission