The corporate mobility industry in Poland is at the threshold of revolutionary changes driven by growing environmental awareness, technological advances and new business models. The ‘Barometer 2024’* report sheds light on the key trends that are shaping the future of fleet management and employee mobility in Polish companies against the background of European data.

Dynamic development of Polish fleets

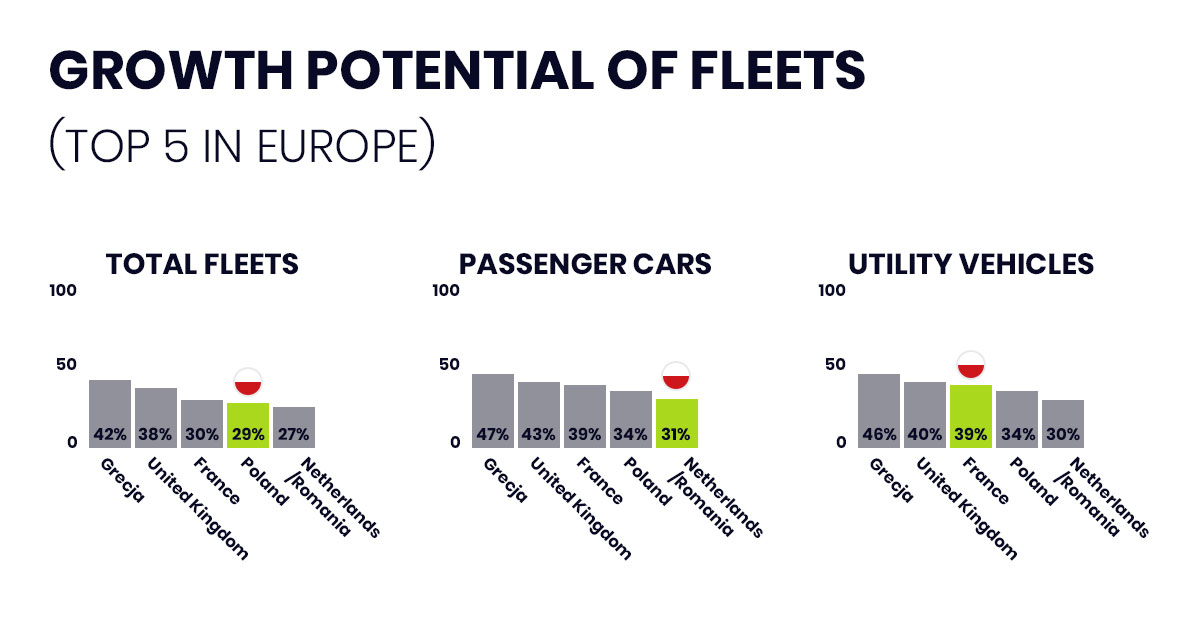

According to the survey, 92% of Polish companies expect the number of vehicles in their fleets to remain the same or increase over the next three years. Almost 30% of companies are planning to expand their fleet, while only 6% are considering reducing it. Poland is at the forefront of Europe in terms of fleet growth prospects. The TOP 5 in Europe for total fleets are:

1. Greece – 42%,

2. United Kingdom – 38%,

3. France – 30%,

4. Poland – 29%,

5. The Netherlands/Romania – 27%.

Fleet growth prospects are particularly evident in the case of commercial vehicles. As many as 39% of respondents declare their intention to expand their delivery fleets in Poland. Greece is again in the lead in this ranking with 46%, followed by the UK with 40% and France with 34%.

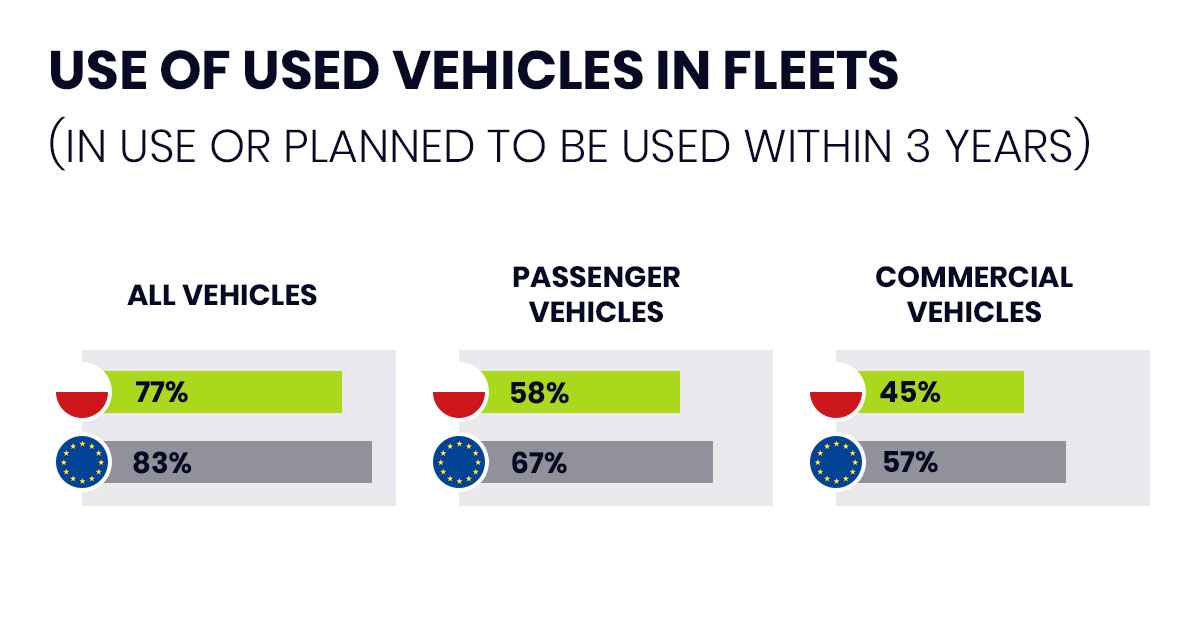

Second-hand vehicles are much more popular in the European Union than in Poland. While in Poland only one in four companies use second-hand vehicles, in Europe more than 40% of companies do so. However, the next three years may narrow the gap, as 77% of Polish companies plan to use second-hand vehicles during this period, compared to 83% of companies in the EU.

Growth of electric and hybrid vehicles

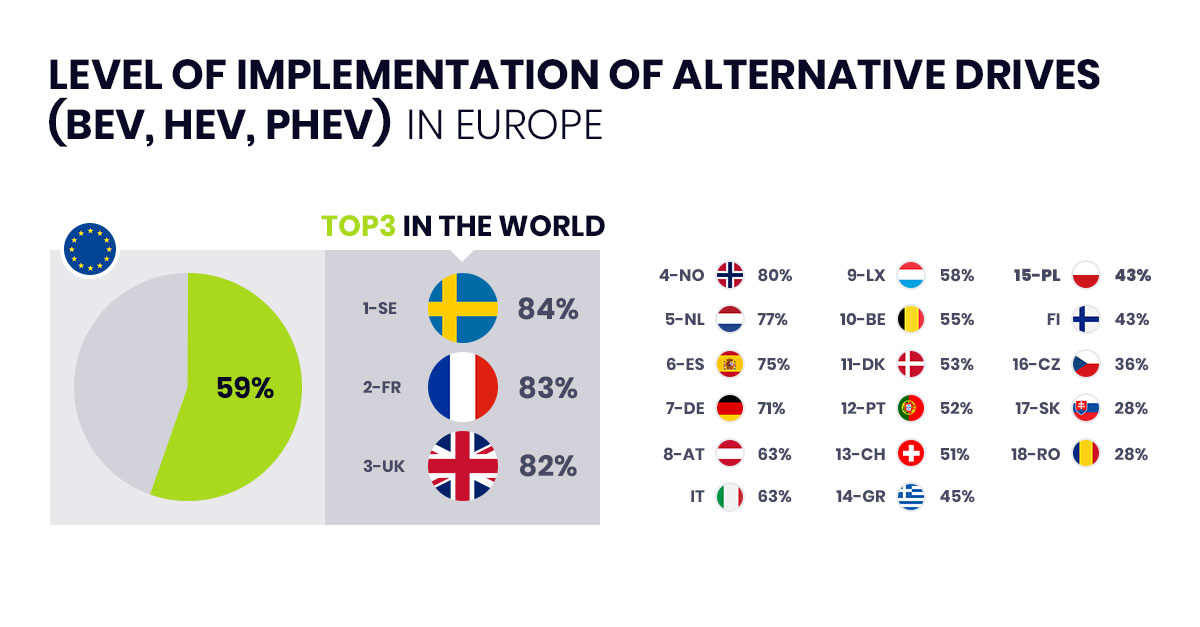

The growth in popularity of electromobility in Poland is steadily increasing, but without a sudden jump. Currently, 18% of companies use at least one fully electric vehicle, an increase of 2% compared to 2023. There is a noticeable jump in this category among large companies, where the percentage using electric cars has increased from 16% to 25%. Additionally, almost 40% of companies declare that their fleets include electrified vehicles. However, this result is below the European average of 59%.

Which companies are slowest to give up combustion cars? The largest ones. In Poland, it is the reduction in fuel expenditure that is the most common motivation for having electric cars in fleets – 48% vs. 29% in the EU.

What, in turn, discourages fleets from implementing fully electric cars?

In Poland, these factors are mainly related to:

– small number of public charging points (47%)

– higher purchase price of the vehicle (46%),

– narrow choice of models (37%).

In the EU, on the other hand, the argument related to:

– low number of public charging points (36%),

– higher price of vehicles (33%)

– lack of charging infrastructure in employees’ homes (29%).

What is the incentive to implement fully electric cars in the fleet in Poland?

– reduction in fuel costs (48%),

– lower environmental impact (44%),

– improvement of company image (34%).

In the EU, on the other hand, the most important factors for companies with fleets of electric cars are:

– lower environmental impact (36%),

– reduction in fuel costs (29%),

– compliance with the company’s CSR policy (26%).

Another point of the survey was the level of implementation of alternative drives (BEV, HEV, PHEV) in Europe. The TOP 3 countries were Sweden (84%), France (83%) and the UK (82%). Of the 18 countries participating in the survey, Poland ranked 15th, on a par with Finland (43%).

Within three years, the estimated share of electric cars in Poland will still be in a distinct minority compared to combustion cars, which are expected to account for 86% of all vehicles. For vans, this share will be even higher (91%). In the EU, on the other hand, more than 40% of passenger cars will be with alternative propulsion systems, among vans almost 30%.

Alternative forms of mobility and the growth of rental interest

Alternative forms of mobility, such as, for example, company car sharing, car sharing, car allowance or car or bicycle rental, are used less frequently in Poland than in Europe. Only 55% of companies in Poland have implemented one such solution compared to 79% in the EU. The TOP 5 in Europe are:

– Norway (90%),

– Netherlands (88%),

– Germany (87%),

– Sweden (85%),

– United Kingdom (84%).

Within three years, 85% of Polish companies say they would like to use alternatives to the company car, and 92% of companies in the EU. The greatest potential is seen by HR departments, who see mobility as a form of employee benefit.

One in three Polish companies is considering using rental services for its fleet. Purchase with own funds has returned to first place among the most popular forms of car financing in companies (35%). The most successful increase in the share of rental is seen in Poland in companies with 100-499 employees and amounts to 37%. In the EU, on the other hand, the same figure applies to companies with 500 or more employees.

Key findings of the survey

1. expansion of company mobility

29% of surveyed companies in Poland (compared to 24% in the EU) plan to increase their car fleet in the coming years.

2. Electromobility

70% of companies in Poland (compared to 77% in the EU) plan to use electrified passenger cars. 34% intend to introduce fully electric cars in their fleet.

3. Electric delivery vans (eLCVs)

20% of companies in Poland (compared to 34% in the EU) plan to use electric delivery vans and 4% already have them.

4. Cheaper by electric means

48% of companies in Poland (compared to 29% in the EU) indicate fuel savings as the main reason for introducing alternatively powered passenger cars in their fleet.

5. Rising interest in rental

33% of companies in Poland (compared to 35% in the EU) are considering using long-term vehicle rental.

6. alternative forms of mobility

85% of companies in Poland (compared to 92% in the EU) plan to use alternative forms of mobility, 55% of which are already using them.

____________________

* The ‘Barometer 2024’ report prepared by Arval Paribas Group is the next edition of a unique study based on extensive research conducted in 30 countries on five continents. The report focuses on the data collected in Poland, showing it in a broader European context. The data was collected at the end of 2023.